How Do Dividends Work?

How do stock dividends work?

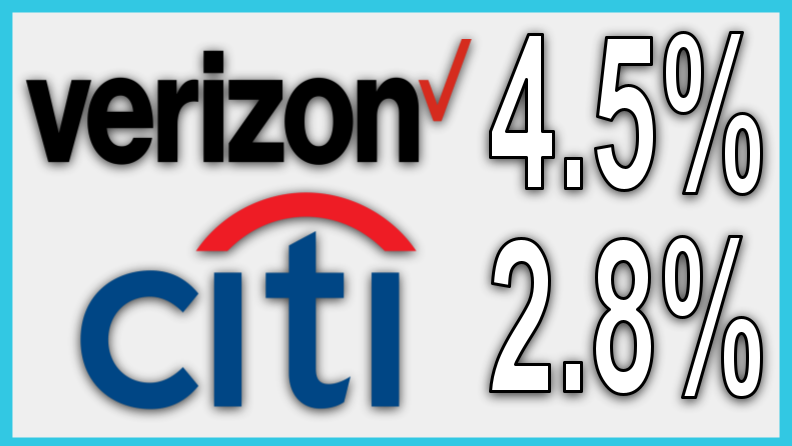

The idea is a company will pay out a portion of their earnings to their owners/shareholders every month, quarter, half year, or year. These companies are trying to offer a steady return for their shareholders by distributing extra income to them. This is why telecoms, generally slow growing companies, can still offer solid returns to their investors because sometimes they can pay out a 5% dividend yield. This gives a consistent 5% yearly return on the shareholder’s investment. And this is why people love dividends.

Now the argument can be made that instead of having a company pay their shareholders, the company itself can use the extra income to reinvest back into the company itself and sustain faster, more reliable growth. At the end of the day, the investor may actually receive a better return and this is a point Warren Buffett has mentioned with Berkshire Hathaway BRK. He thinks that Berkshire can use the extra money to reinvest in stocks and that it is more beneficial to keep it and buy back their own stock rather than pay a dividend. But then you have to watch out to make sure you’re not over invested in one stock as compared to another and also, if you’re looking for dividend income from, let’s say a retirement portfolio, then you won’t be able to achieve that easy income. So there are upsides but also downsides to the method.